Is the Guitar Market Oversaturated?

What happened to the global guitar market and is it oversaturated?

Is the Guitar Market Oversaturated? The word “oversaturated” is tossed around on forums and in guitar shops, especially after the explosive sales boom during the pandemic. But is the market truly flooded, or is it just evolving?

Is the Guitar Market Oversaturated?

Is It Really Oversaturated?

Because I write about guitars, I have spent most of my life around them, and have many friends in the guitar industry. I also hang out on a lot of guitar forums, and for the last year or so, there have been many murmurs of the “Oversaturated Guitar Market” and a “general poor state of guitar sales worldwide”.

However, I actually believe this may be really affecting the used market, partly because ‘online sales’ of used items appear mainly to be priced way above what they are actually worth.

Post-Pandemic

My analysis led me to explore the post-pandemic landscape, deep market segmentation, and the powerful rise of the used-gear ecosystem to find the answer. I have been researching this on and off for most of the year, and some of my information comes from sales figures, while some comes from word of mouth via people I talk with in the guitar industry.

Obviously, the 2020-2022 period was unprecedented, and with lockdowns and a search for new hobbies, guitar sales exploded. That period was pretty insane, and many people were paying top dollar for new guitars, and used sales went through the roof, with prices and sales moving quickly.

Fender reported millions of new players globally. This surge led to supply chain crunches and a feeling of infinite growth.

Used Guitar Apocalypse

However, 2023-2025 has seen a predictable “market correction”, and it appears that many guitarists haven’t caught up with this. I keep seeing online posts of guitarists trying to sell their gear, and it’s not moving. I have seen multiple YouTube videos on the topic over the last 12 months.

Below is one such example of a US store, and this is their second year of making a video on the subject (yes, I watched the original one when it was first released as well) and sharing their experiences.

A Year of Closures

We also saw many guitar-related businesses worldwide go out of business (one Brighton store I worked at in the 1990s was headline news here in the UK earlier this year). Then there was the news that John Hornby Skewes & Co (JHS), another well-known name in the UK music industry, announced its closure after more than 60 years in business, and that same week Fernandes Guitars filed for bankruptcy.

I would say that almost every month this year, I have had news of smaller independent retailers closing their doors.

Sales have certainly slowed from their pandemic peak as people’s disposable income has tightened due to worldwide economic squeezes.

A local guitar store near where I live told me this summer that they had noticed people were far more cautious about buying new gear. Whilst another guitar store near me closed down completely during the summer and went bust.

Saturated or Just Strumming a New Tune?

From my research (and I’m no expert), I would suggest that the “guitar market” isn’t one single entity. I would suggest it can be broken down into three distinct categories.

Below, I have divided them into brief explanations of each. Plus, the used market has its own unique subsets of sellers.

Premium Market

Brands like Gibson, Fender (USA), and Martin are feeling the pinch. Their high-priced, heritage-focused instruments are a major purchase.

While still strong, this segment is most affected by economic slowdowns and the booming used market, where a 2-year-old model can often be found for a fraction of the price of a new one.

Budget & Mid-Range Market

This segment is thriving. Brands like Squier and Epiphone, as well as direct-to-consumer giants like Harley Benton, offer incredible quality at affordable prices.

New players, hobbyists, and guitar modders flock to these, sustaining high-volume sales. This part of the market shows no real sign of saturation and continues to grow.

Especially, as the quality of these mid-range, budget instruments is so high and brands like Harley Benton (Gearnews is associated with Thomann and Harley Benton, so see how popular these models are worldwide) are smashing it out of the park in terms of value for money.

Boutique Market

Small-batch, custom builders operate in a niche, high-margin world. They are less affected by mass-market trends and cater to specific player demands, often with long waitlists.

Many of my friends are in this sector and build beautiful instruments; they appear insulated from broader saturation concerns by their exclusivity and direct customer relationships.

Used Guitar Market

For guitar manufacturers, the most brutal competition isn’t another new brand—it’s the used guitar market. Online platforms, especially Reverb.com and eBay, have unlocked a huge “shadow inventory” of second-hand instruments, making it highly liquid and easy to buy.

Because players can now find virtually any guitar from any time period, often in perfect condition, this availability has two significant effects: it drives down the price of brand-new items and offers players unlimited choice.

Scalpers & Bedroom Dealers

We also have the scalpers to contend with, the ones who buy up all the stock and then attempt to resell at overinflated prices. The best way to deal with them is not to buy from them. They will be stuck with stock, so their money will be tied up, and eventually they will have to sell at a realistic price.

There are also many bedroom dealers who often sell used guitars for more than retail price, and this has become more common in the UK since the pandemic. Many of them live in a fantasy world when it comes to their prices, and they often low-ball individual used guitar sellers to maximise their profits.

These last two are causing issues with used sales for many people, and my advice is to never buy from either type of seller. As Obi-Wan says in Star Wars, “You will never find a more wretched hive of scum and villainy,” and that’s my take on these two sectors of used sales.

So, is the guitar market really oversaturated?

I would say that it is not oversaturated.

The budget market is booming, the used market acts as a massive parallel ecosystem, and the premium market is simply returning to a more sustainable, pre-pandemic pace. The market isn’t dying; it’s just finding its new rhythm.

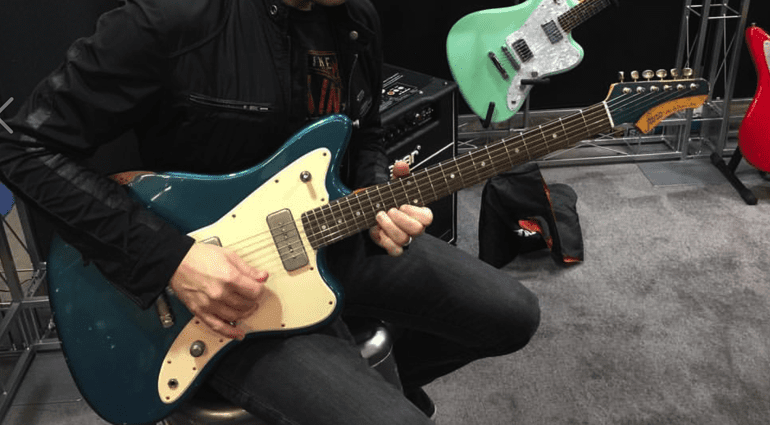

I would also say that a high-quality guitar can be purchased for very little money, and that our choice of available guitars is now huge. There are so many different new models on the market now. There is a glut of choice, not necessarily a glut of unwanted product.

People selling on the used-guitar market need to be more realistic with their pricing, especially when brand-new, high-quality guitars can be purchased for very reasonable prices.

According to Google, the guitar market is doing well: “The global guitar market size was approximately $10.3 billion in 2022 and is projected to reach nearly $20 billion by the end of 2025, with a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030.”

Let me know what you think in the comments section below.

5 responses to “Is the Guitar Market Oversaturated?”

You are currently viewing a placeholder content from Facebook. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

3,7 / 5,0 |

3,7 / 5,0 |

You’re not wrong, but you’re not right. It’s very over saturated, guitar brands have a new model at least every cluck of a chickens girdle. Not to mention the over production of these cow brains that are hardened into utter protectors. The used guitar market has a strangle hold on the flocks of Australian emu’s and it seems that the online guitar market is quietly buzzing the down off of geese simply for guitar pillows.

Something to think about. Thanks

You need to rely on more data. Too many assertions based on vibes. Now I will make the same mistake.

The guitar market is changing, and used sales now occupy a much larger place in the market. That is a good thing, however, because it drives new guitar sales—many new buyers sell or trade their current instrument to finance that sale.

Vintage instruments seem terribly overpriced at the moment, but that may be the new normal. There are more collectors than ever before, and Boomers are selling to Xers. This will cool at some point, but it’s going to take awhile.

The boutique market is growing but is seriously constrained by the number of luthiers in the trade—that group is shrinking. Also, their margins are not great at all. A retailer can expect higher margins from Fender or Gibson than they can from Collings or Lowden—and the boutique brands sell more slowly at most retailers.

The big issues effecting retailers are 1) direct selling from Fender, Gibson, and others. 2) inability to get quality boutique stock to support a business and 3)US tariffs, which drive up prices for new instruments

I don’t know about that (I have my own view but it’s not based on data). But I am certain that every company under the sun dishing out ‘artist signatures’ like free sweets, while a good thing for those who want to own them, has completely devalued the concept. Sort of like awards for everyone at school.

Here’s the obvious problem with your argument. You say 2020-2022 was unprecedented in sales volume. You then say the new guitar market is simply finding its new rhythm. You then say that to many used sellers are overpriced and unable to find many buyers. So if for 2 years, unprecedented volume occurs, then after that time the sales of used guitars slumps majorly, there can be no other result than over saturation. I agree there is more choices than ever in the used market but if the same choices mainly exist in the new market for the same or less money, used sales will continue to be static.

In my opinion, eventually the used market prices will fall drastically for a time and this will likely affect new sales negatively. Then, as all markets new and used slow, they will eventually settle into a new rhythm. Whether that will result in the failures of many newer and less insulated manufacturers is the question. Sooner or later the guitar market will have to adjust to losing the majority of the new customers who were created by the pandemic.

It’s a complex confluence of many factors:

– Post-pandemic market correction

– Gen-Z’s move away from traditional guitar-based music

– The onset of digital

– Trump tariffs causing market fluctuation

– Deflated U.S. economy

– Continued diversification of brands, which is now starting to reverse

I suspect that the market will stabilize in a few years, but in the meantime the market will correct and cause some of those smaller and mid-market dealers to go out-of-business or be consolidated into larger companies that can better weather the storm. We’re already seeing it with G&L and there will be more next year.